BELIZE CITY, Wed. Mar. 2, 2016–After a special session of Cabinet on Thursday the proposed billion-dollar budget for the year 2016/2017 to finance Government’s operations for the new fiscal year, including the payment of a final tier of salary adjustments to teachers and public officers, is slated to be tabled in the National Assembly on Tuesday, March 8.

The subsequent budget debate will be held on Tuesday, March 22 and Wednesday, March 23, while the Senate should consider the new budget at its meeting slated for Tuesday, March 29.

Belizeans are always curious whether the proposed national budget will come with new tax measures. Just last week the Government of Belize increased import duties at the fuel pumps, raising the levy on gasoline and diesel for a second time since December 2015.

Threshold for cash declarations by travelers to increase from $10,000 to $20,000 with new money laundering amendments to support MoU with Customs Department

We asked Deputy Financial Secretary Marion Palacio about the possibility of new tax measures for the budget year and he told us that it is currently Government’s thinking that apart from adjusting the import duties, no new tax measures would be taken.

Palacio said that the price drop for fuel products on the world market has been a sort of a “double-edged sword.” While it has meant overall savings for consumers, it has also meant lower receipts from crude oil sales for the Government of Belize. In both cases the revenue which the Government gets—in the first instance, from the sale of fuel at the pumps, and in the second instance, from a revenue-sharing arrangement with Belize Natural Energy—has declined.

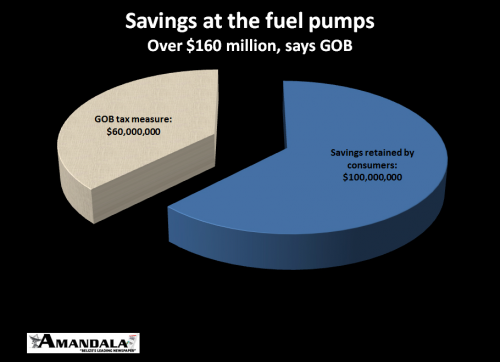

In its press release issued on February 24, right before the second hike in import duties, the Government said that the total “windfall” savings to consumers since prices held high in December 2014 and early 2015, amounts to roughly $163 million, and consumers have kept over $100 million of those savings. It means, then, that the Government has retained roughly $60 million or about a third of the pie.

We asked Palacio whether the formula for adjusting import duties at the pumps would apply if market prices on fuel and crude begin to escalate—which would mean that the import duties on fuel would be reduced—we are advised that the decision would have to be made by Government executives.

We understand that the budget speech which Prime Minister and Minister of Finance Dean Barrow is slated to deliver next Tuesday is currently being prepared. Apart from presenting the budget highlights, that speech usually presents a preliminary review of the outgoing budget year, as well as an overview of the performance of the wider Belizean economy and the forecast for the next fiscal year.

Although the national budget is the headline item on next Tuesday’s agenda, there are other business items listed. Amendments to Belize’s money laundering laws and Customs laws feature prominently among them. An official source told us that the amendments follow a memorandum of understanding (MoU) recently signed by the Customs Department and the Financial Intelligence Unit (FIU).

An official release had said that the MoU would “facilitate the reporting of international transportation of currency and monetary instruments… [and] …increase the potential sources of information available to the FIU and Customs to properly undertake their analytical and investigative functions.” The MoU “also ensures that the requirements to declare and report any cross-border movement of cash andnegotiable instruments will be more efficient and less burdensome on people seeking to move such assets into and out of Belize,” the Government added.

Next week an amendment will be proposed to the Money Laundering and Terrorism (Prevention) Act, No 18 of 2008, “to provide for measures to ensure compliance with international standards and obligations in relation to money laundering and terrorist financing and implementation of UN Security Council Resolutions.”

The Customs Regulation (Amendment) Bill, 2016 proposes “to amend the Customs Regulation Act, Chapter 49 of the Substantive Laws of Belize, Revised Edition 2011; to provide for measures to ensure compliance with international standards and obligations in relation to money laundering and terrorist financing…” The amendment would also raise the threshold for cash declarations for travellers from BZ$10,000 to BZ$20,000. The Government says that the intent is “to simplify procedures for currency declarations…”

As a follow-up from a bill introduced at the last sitting of the House, amendments to Belize’s Extradition Act, to include Mexico among the countries to which Belize can extradite fugitive criminals of interest, should go back for a second reading, after a report from the Constitution and Foreign Affairs Committee.

At Tuesday’s sitting Government will also seek parliamentary approval for a 20-year loan from the OPEC Fund for International Development (OFID) for US$11.78 million, for an “airport link road project. This project is for a road to connect Western Paradise at Mile 8 on the George Price Highway with Ladyville on the Philip Goldson Highway.