BELIZE CITY, Wed. Mar. 2, 2016–The Belize Electricity Limited (BEL) announced today that it would be issuing a new series for $27.5 million worth of debentures at $100 a debenture, at an interest rate of 6%, slightly lower than the 6.5% rate offered in its last issue.

BEL says that until March 11, 2016, it will give first preference to holders of its series 2 and 4 debentures. Thereafter, the debentures that remain would be offered to the general public, up to the closing date of March 31, 2016.

In its 2014 annual report released last year, BEL documented that it had issued debenture subscriptions with an aggregate value of $77.5 million. The report had indicated that the series 2 debentures could be called by the company any time after April 2008 and the series 4 debentures any time after September 2014. Subscribers need to have at least 30 days’ notice before the debentures are to be called.

The new series 7 debentures would mature in 2028, but in 2022 holders could exercise their put option to redeem the debentures, while the company would then, likewise, be able to exercise its call option on the instruments.

Doug Singh, chairman of the Social Security Board (SSB), which holds over 20% of BEL’s shares, has indicated that it is an investment that the SSB could consider, if debentures will be made available to the SSB. The rate on the BEL debentures is better that what the SSB would earn from the banks, and according to Singh commercial interest rates are forecast to remain low for the next three to five years.

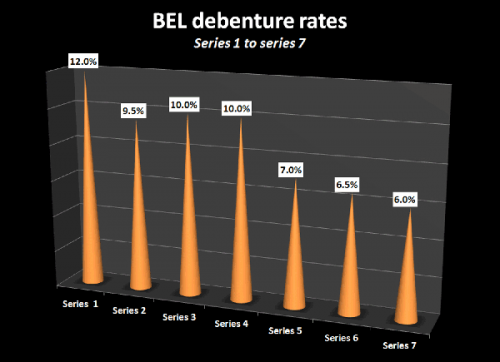

The new debenture rates are half what BEL had offered its first series, and there have been successive declines over the years, with rates now down by half. Its first debenture series was reportedly issued back in the late 90s for $16.9 million at 12%—the highest debenture rate ever offered by the company. In 2012, holders of those debentures were offered new terms under series 5, which attracted a rate of 7%.

In May 2014, BEL similarly refinanced $24.8 million worth of series 3 debentures, which carried an annual interest rate of 10%, resulting in the series 6 debentures for $25 million at a rate of 6.5%.

The company forecasts continued profitability until the year 2020. In the prospectus for the 2016 debenture it reports a $36.2 million profit for 2014, but it forecasts a decline in profit to $21.4 million for 2015 and a further decline to $18.5 million for 2016. Profits for the period 2016-2020 should remain in the range of $18 to $20 million, according to the company’s projections.