Belize’s S&P long-term foreign ratings approaching “selective default”

“…either a missed payment or an exchange that we view as distressed constitutes a default.”

“The ratings could stabilize at this level if the government makes the payment and forgoes debt rescheduling negotiations.”

Immediately after the Government of Belize announced on Tuesday that it won’t be able to meet the August 20, 2012, super-bond payment of BZ$46 million in interest charges, the international ratings agency, Standard & Poor’s, downgraded Belize’s long-term foreign currency ratings from “CCC” to “CC”—from vulnerable to highly vulnerable—marking it with a negative outlook.

“The negative outlook reflects the prospect that we will lower our foreign currency ratings to ‘SD’ [selective default] if the government misses its Aug. 20 payment as announced, or if it proposes a debt exchange to investors,” said the ratings agency in a press release today. “The ratings could stabilize at this level if the government makes the payment and forgoes debt rescheduling negotiations.”

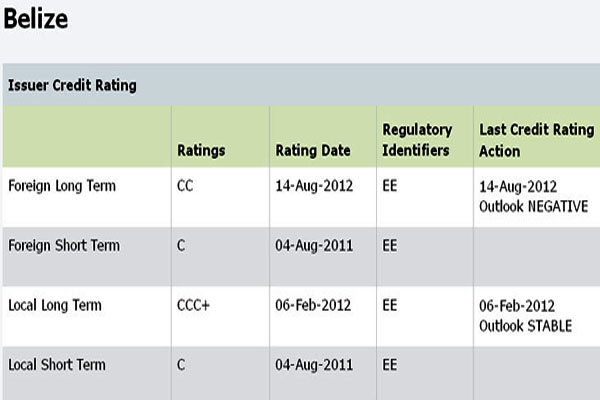

As shown in the accompanying table, the other currency ratings for Belize remain unchanged.

“The rating action follows the government’s announcement today that it will not pay the US$23 million semiannual coupon due on Aug. 20, 2012, on its US$546.8 million bonds due 2029. The interest rate steps up [from 6%] to 8.5% on the accrued interest due this month,” said Standard & Poor’s credit analyst Kelli Bissett.

The Barrow administration has commenced negotiations with bondholders to restructure the transaction by reducing the rate of interest to as low as 1% and extending the maturity date by 13 to 33 years, to 2042 and 2062, depending on the scenario chosen. As we report elsewhere in this edition of Amandala, bondholders have reacted negatively to the proposed scenarios.

The S&P report said, “On March 19, 2012, the Government of Belize initiated a review of its external public debt, and on Aug. 8, the government published indicative restructuring scenarios.”

The report added that “either a missed payment or an exchange that we view as distressed constitutes a default.”