BELIZE CITY, Mon. Dec. 14, 2015–In yet another multi-million-dollar litigation between the Barrow administration and the Ashcroft Alliance, the Government of Belize continues to be at loggerheads with Belize Investment Services Limited (BISL) over the Government’s 2013 decision to rescind its 20-year-old arrangement with the company, which had been handling the registration of international business corporations (IBCs) and merchant marine ships under Belize’s jurisdiction. The matter is expected to go to full hearing in the Supreme Court in early 2016.

For its part, BISL is claiming that the Government should pay US$45 million in damages—the Government, on the other hand, says it owes BISL zilch!

Supreme Court Justice Michelle Arana is expecting to receive written submissions to be filed by this Friday, December 18, 2015, in preparation for the hearing.

Last week, Arana received pretrial submissions from the parties and she heard from expert witnesses for both the claimant and the respondent, as attorneys for both sides argued over the validity of a contract dating back to the days of the Rt. Hon. George Price, now deceased.

Amandala readers will recall that in June 2013, the Barrow administration took full control of the International Business Corporation (IBC) Registry and the International Merchant Marine Registry of Belize (IMMARBE), which had been under the control of British billionaire Michael Ashcroft and Panamanian investors with European connections since 1990 and which were operated out of the Marina Towers in Belize City.

BISL had held the management contracts for the registry dating way back to 1990, when Belize’s first premier, Price, was serving his second term as Prime Minister and also as Minister of Finance.

After the Government rescinded that longstanding arrangement, BISL fired back with a threat to sue for US$60 mil, insisting that it has “a legally enforceable contractual right to operate and manage these two registries on behalf of the Government of Belize until June 2020.”

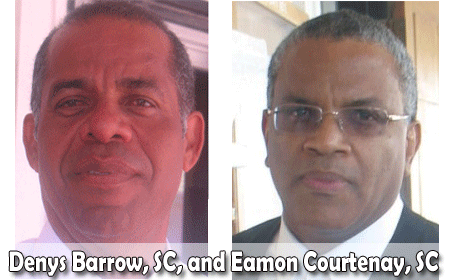

Eamon Courtenay, SC, attorney for the claimants, told Amandala today that his client’s case is “very simple and straightforward.”

“They had signed a contract in 1993 with the Government of Belize, and it was for them to provide services at the request of the Government. They performed [on that contract] for 20 years and at the end of 20 years, with still 7 years to go, the Government decided that they didn’t want to continue,” Courtenay told us.

He said that the Government has attempted to justify its “breach” with “trivial academic technicalities,” while pointing to the Financial and Stores Orders and the Constitution of Belize.

According to Denys Barrow, SC, attorney for the Government, the contract (which dates back to 1993 with a 10-year renewal in 2003) was extended by the Musa administration in 2005. That, Barrow told us, happened 8 years before its expiration, taking the contract period all the way to 2020. This was done “out of the clear blue sky and with the motives unstated…” he added.

Barrow contends that another area of irregularity under the contract is that BISL had been collecting taxes, as imposed by law, and paying those funds into their bank account, where the Financial Secretary or the Auditor General could not access them, when the Constitution requires such funds to be paid into the Consolidated Revenue Fund.

“In the first instance, the Financial and Stores Orders don’t apply to our client. They do not apply in circumstances of this case,” Courtenay told us.

He added that the initial agreement of 1993 was amended in 2005, and the Government is now saying that in 2005, when an extension was granted, it should have been put to tender.

“That is flat wrong in our opinion. In so far as the Constitution is concerned, the Government’s argument is that the agreement provided for money to be paid to the IBC registry and IMMARBE which should have been paid to the Consolidated Revenue Fund. That is a matter for Government: It is the Government who signed this agreement. The Government received monthly reports and there has been no complaint from [Joseph Waight, one of the Government’s witnesses] as the Financial Secretary as to that arrangement, neither the Auditor General nor the Accountant General for over 20 years,” Courtenay said, adding that this second prong of the argument is now merely academic, since the Government took over the registries two years ago.

Courtenay contends that Dr. Peter Hern, who was on the stand for 4 hours, during which Courtenay questioned him in cross-examination, has no expertise in the area and should not have been brought in as an expert witness.

The Financial Secretary also appeared on the stand. Courtenay said that Waight had admitted in court that the Ministry of Finance can exercise discretion over whether or not a contract goes to tender.

We asked Courtenay about the legal requirement for tender, but he said that the requirement does not necessarily apply. The argument that he will advance in court is that where the law says something “shall” be done, it does not mean must.

“It is directory rather than mandatory,” Courtenay said.

We asked Courtenay, who previously served as Attorney General under the Musa administration, whether he ever dealt with the BISL contract or provided legal advice on it while working with the Musa administration. He told us that he did not. When the 2005 extension was granted, Opposition Leader Francis Fonseca, who succeeded Courtenay, was the Attorney General.

“I encountered an agreement that had been signed and executed. The question before me, and the question before the professionals at the Attorney General’s office and the Ministry of Finance was in 2005, that was the only question before me, was could this contract by letter be extended for a further seven years?” Fonseca said, when questioned on the matter back in June 2013.

Both BISL and the Government had three witnesses appearing before the court last week. The main witness for the claimant was Peter Clokey of PricewaterhouseCoopers Legal LLP.

Barrow told Amandala that he cross-examined Clokey for two hours, probing him on matters such as the US$45 million which the claimants contend they have lost because of the Government rescinding its arrangement with BISL.

The Government believes nothing is due to BISL, Barrow told us, because the contract is not valid since it was never put to tender, contrary to the Financial and Stores Order. He said that at the time of the agreement, contracts of $10,000 or above had to be put to tender, but that figure was later revised to $100,000, which he contends applied to the BISL contract.

He said that he intends to focus his written submission on this point in what he expects will be a document of roughly 8 pages.

On May 6, 2013, the Government wrote to BISL indicating that it would take over the registries, but BISL replied on the basis of a 2005 letter of agreement, which, it said, secures their contract until 2020.

However, Gian Ghandi, legal advisor in the Ministry of Finance at the time and then registrar who has since passed away, had told Amandala that in 2003, there was a dispute between the then People’s United Party administration of Said Musa and BISL, over whether the agreement should have been extended.

Ghandi said that he had written a letter on June 9, 2003, indicating that “there has been a fundamental change of circumstances since the Agreement was signed in 1993 and that this affects the continued validity of the agreement.”

Ghandi also indicated that at the last meeting of the International Financial Services Commission (IFSC) which oversees that sector, they had agreed to only a short contract extension of two months with effect on June 12, 2003. He added, though, that the registries continued to be under the control of BISL, although there continued to be a back and forth over the validity of the extension.

Former Finance Minister and ex-Prime Minister Said Musa had told Amandala when we queried Ghandi’s assertions that the 2005 renewal and extension to 2020 was vetted first of all by the Ministry of Finance, the Attorney General’s ministry, and senior public officers.

“We were able to secure a consideration of US$1.5 million for this seven-year additional extension. That money was used indeed for the expansion of the primary school infrastructure program,” Musa had told us.

Prime Minister Dean Barrow had told the press, when the matter of the US$1.5 mil payment was raised, that there is a record of Government having received a US$1.5 million at the Central Bank around that time in 2005, and Government will reimburse those funds to BISL.

Under the arrangement, Barrow said, the Government of Belize received 36% of gross revenues. He said that the agreement required BISL to pay the Government of Belize 60% of funds left behind after 40% was subtracted for expenses. News reports of earnings by the registries have ranged from US$10 million to US$12 million annually. BISL’s portion was 64%.

Earlier this year, the Government entered into settlement agreements with the owners of two other entities it had nationalized in recent years – Belize Telemedia Limited (BTL) and Belize Electricity Limited (BEL), putting an end to years of litigation. In the former case of BTL, the Government had taken the position that while it had appropriated the US$22.5 million loan which BTL held with an Ashcroft-affiliated bank, it would resist paying it on the grounds that the loan was illegal. However, the Government lost at arbitration, which awarded the bank US$48 million, now included in the recently concluded settlement deal.

In the case of BISL, the Government said that it did not amount to nationalization, since the registries were only being managed by BISL on the Government’s behalf. The question, then, that the court is expected to answer is whether BISL should be compensated for the contract which it claims had a life of 7 more years when the Barrow administration terminated it.