Ghandi says definition of spouse harmless, since Belize law criminalizes same-sex relations

The Domestic Banks and Financial Institutions Bill, approved by Parliament last week, has been stirring up the church community, because, to them, the definition of the word “spouse” in the bill appears to expand the meaning to include same-sex couples.

Government’s legal counsel in the Ministry of Finance, Gian Ghandi, told Amandala that the bill is linked to the debt restructuring exercise and the definition now being disputed was in the bill ever since the International Monetary Fund (IMF) drafted it about 6 months ago. Ghandi said the definition of spouse is being totally misunderstood, as it was never their intention to widen the meaning to include same-sex couples.

Ghandi pointed to existing provisions in the Criminal Code (Section 53) which outlaw same-sex relations, and he said that as long as those laws are on the books, no other legal meaning could be construed for the word “spouse” in Belize, which he described as a very religious society to which the sanctioning of same-sex relations is abhorrent.

Ghandi said that during all the reviews of the banking bill, and even during the house committee meetings at which public input could have been given on the bill, no one ever raised concerns about the way spouse is defined in the act.

The bill says “spouse” is defined as “an individual person, a wife, husband, or other individual with whom the first-named natural person is engaged in an ongoing conjugal relationship, whether common-law union as defined by section 148(D) of the Supreme Court of Judicature Act, or not and whether or not the two persons are living together.”

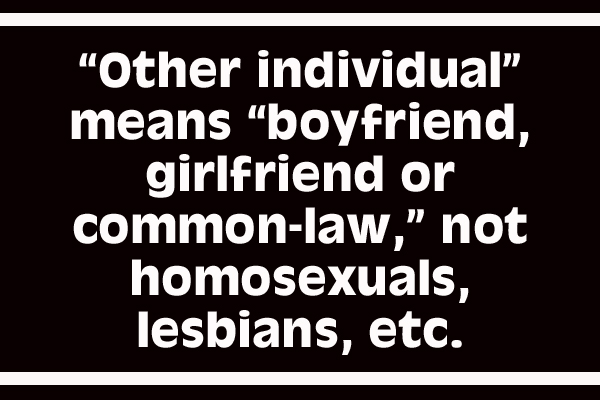

According to Ghandi, the scope of spouse has been expanded so that it could include a boyfriend and girlfriend, or couples who live together for less than the current 5-year limitation stated in existing laws. The reason for doing so, he said, is to expand the scope of what the banking sector can consider as “related party transactions” under sections 68, 69 and 71 of the new banking law.

The church community says that the definition, which does not stipulate that a spouse has to be a member of the opposite sex, as does the provision in the Domestic Violence Act, is heading down a “dangerous road.”

Roman Catholic Bishop Dorick Wright led a delegation from the churches last Thursday to speak with officials at the Central Bank about the definition of “spouse” in the bill.

The day before, Rev. Noel Leslie, Senator for the churches, voted against the bill. He told Amandala that were it not for the definition of spouse in the bill, he would have voted in favor.

“The churches have a policy against same-sex relations and at first glance when you read [the bill] you can jump to a conclusion,” Leslie told our newspaper last week.

Leader of Government Business in the Senate, Senator Godwin Hulse, told Amandala in response to the concerns conveyed that the Government could amend the definition if the churches are “making heavy weather over it.”

The private sector also did not support the bill because in its view, it contains provisions that are too “draconian.”

Private Sector senator Mark Lizarraga said, “[The Domestic Banks and Financial Institutions Bill] gives the Central Bank a lot more power…some say, too much more power.”

Lizarraga said in the Senate that it is their understanding that the bill could be a part of the Government’s commitment to the Inter-American Development Bank (IDB), in exchange for support of the super-bond debt restructuring.

He added that “…some in banking have complained that the Bill creates substantial legal and regulatory uncertainty, and that the Bill also does not provide adequate checks and balances on such power it proposes to give to the Central Bank. There are familiar sayings about power, and the abuse of power, which I need not voice, Mr. President.”

Amandala understands that the move to revise the banking laws goes way back to 2004 and that the process has met a lot of opposition from a particular bank.

Speaking in Parliament just over a week ago, Prime Minister and Minister of Finance Dean Barrow had said that the main opposition to the newly approved banking bill had come from the Belize Bank.

Leader of the Opposition People’s United Party, Francis Fonseca, had urged Parliament, however, to duly consider the concerns that have been raised over the bill.

Fonseca had also said that the banking sector is concerned that the bill would operate as a substantial disincentive to the development of the financial sector of Belize.

Prime Minister and Minister of Finance Dean Barrow responded to concerns over the potential abuse of power by saying, “Any power given to any regulatory authority is subject to abuse; but that’s why there are the courts… the Constitution and the legal remedies by way of judicial review that subject authorities to scrutiny.”

One section that Fonseca hinted may be subject to scrutiny is section 73.4, which addresses financial statements, reports and accounts, and which, he said, requires banks to provide customer information to the Central Bank at any time upon request. He said that concerns were raised at the House Committee level that this may very well be found to infringe on the right to privacy set out under section 14.1 of the Belize Constitution.

Amandala is attempting to get official input from the Central Bank’s Governor Glen Ysaguirre on the history, importance and development of the Domestic Banks and Financial Institutions Bill.