BELIZE CITY–The courtroom of Chief Justice Kenneth Benjamin was filled with about a dozen attorneys yesterday, Tuesday, because the Belize’s Financial Intelligence Unit (FIU) had made a move to freeze the assets of six companies and their employees who were indicted on money laundering and securities fraud charges in a United States Federal District Court in Brooklyn, New York, on September 9.

All media representatives were asked to vacate the courtroom as the arguments over accounts that the FIU had secured a court order to freeze in Belize’s banks got underway “in chambers.”

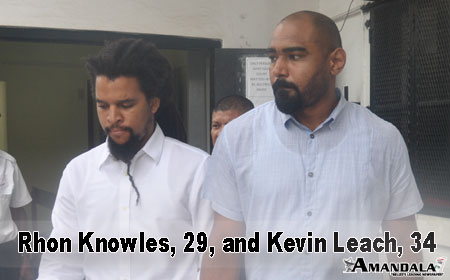

The six individuals who have been indicted in the U.S. are Belizean, Andrew Godfrey, 51; Bahamians, Kelvin Leach, 34, and Rhon Knowles, 29; Canadians Brian De Wit, 45, and Cem Can AKA Jim Can, 44; and American Robert Bandfield,70.

Knowles and Leach were released on Supreme Court bail after they were arraigned on an FIU charge of attempting to leave Belize with more than the prescribed amount of money allowed under the law. After the two were granted bail at the Magistrate’s Court, however, they were rearrested and taken directly to the Belize Central Prison.

Their incarceration, however, proved to be legally flawed, because they had not been taken before a Magistrate on the provisional arrest warrant that was used to remand them to prison.

The Belizean-based corporations that have also been listed in the indictment by the U.S. grand jury are IPC Management Services, LLC; IPC Corporate Services, Inc.; Titan International Securities, Inc.; Legacy Global Markets S.A.; and Unicorn International Securities LLC.

According to the U.S., the six individuals and the companies named in the federal indictments devised an elaborate scheme that allowed U.S. citizens to evade securities and tax laws.

U.S. attorney Loretta Lynch, in announcing the indictment on September 9, said on the Federal Bureau of Investigation (F.B.I.) New York Field Office website, “Today’s sweeping indictment, charging the individuals and companies responsible for this $500 million scheme, closes this fraudulent offshore safe haven and sends a strong message to those who seek to abuse the financial markets in order to enrich themselves … we will investigate and prosecute them no matter where they set up shop.”

The individuals named in the indictment, with the exception of Bandfield, who was arrested in the U.S. and was arraigned on the charges and released on bail pending his trial, will eventually be requested by the U.S. in accordance with the 2000 Extradition Treaty between Belize and the U.S.

While none of the accused individuals have been subjected to the slow-moving extradition process as yet, since no one from the group of accused persons has been remanded to prison, which is a standard procedure in the extradition process, Belize’s FIU has moved and secured a court order to freeze the accounts of the companies and individuals in Belize’s banks.

Upon exiting the courtroom, Eamon Courtenay, S.C. one of the attorneys in the case who declined reporters’ request for an interview, had said during the bail application in the Supreme Court for Leach and Knowles that “there will be one hell of a fight,” because one of the offences for which his clients have been indicted is not contained in Belize’s laws.

Attorney Michael Young, S.C., who represented Unicorn International Securities, LLC, however, told the waiting press corps that, “What has happened is that there have been freezing orders which have been granted by the court on the application of the FIU and in respect of the respondents, various attorneys who represent the respondents have made applications for these freezing orders to be discharged.”

Young added: “There have been a flurry of applications between the FIU, on the one hand, and the respondents on the other, and what we dealt with this morning on the part of the court was what we would call housekeeping. These applications are going to be heard; of course the respondents say that the freezing orders should not have been granted, and should be discharged, and the court has set October 27 to hear the applications.”

According to the FBI, the efforts to prosecute financial crimes came from President Barack Obama’s Financial Fraud Enforcement Task Force (FFETF) which was created in November 2009.

Since its creation, FFETF is credited with bringing 10,000 financial fraud cases against nearly 15,000 defendants, the FBI reported.