by Colin Hyde

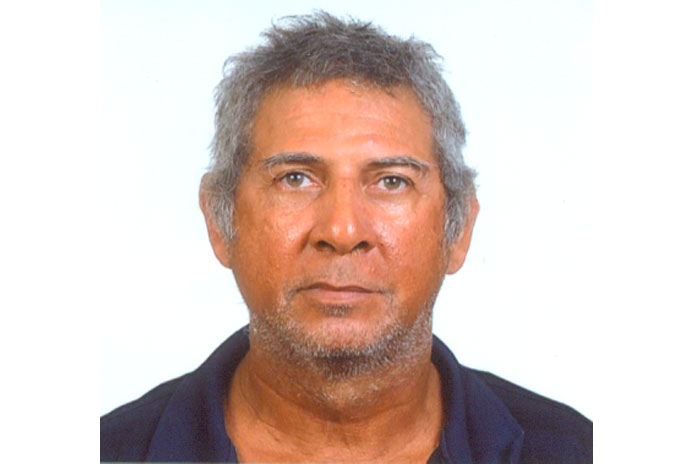

This week the highly accomplished, unique, always exciting Joseph Augustus McGann went on to be with the ancestors. While I wasn’t among his closest friends, we were good. Every time we met he had a very mischievous smile and a twinkle in his eye. He called me “Colin bh”. Sometimes we spoke about my columns.

I knew Joe from when he was managing CARICOM Farms for CARDI in the 1980’s. I worked as a technician on the research station, and he managed the commercial section, so our paths didn’t cross daily. Whenever it did, we had great camaraderie. He liked football and he headed the committee in Belmopan for some years. Joe McGann considered himself the foremost expert on Jamaican music. I adore Keith and Enid, all the old roots Jamaican artists. One day he invited me to his house and opened up his prized collection for me.

We were from different economic brackets, and he had his special crowd, so we didn’t meet that often. He stopped by sometimes when I had a little place in the village. He was close to my brother-in-law, Franklyn Magloire, and we got to chat when Franklyn and my sister invited me over to their house in Camalote when they had an “island” gathering. Meeting Joe was always refreshing.

I knew he had cancer, but I didn’t know he was so ill. A couple weeks before he died, we talked on the phone, and I told him I’d met a friend of ours, and the friend told me he had the disease. I told him I told the friend that everyone who reaches 70 has cancer; the question was how aggressive it was. Unfortunately, the cancer Joe had was very aggressive.

Bye, Joe. I bet your closest friends have a thousand tales to tell. I have some too, but not here. You were a one-of-a-kind guy, a special guy. I treasure knowing you.

Countries with a conscience believe in income tax

I think Manuel Esquivel and the UDP were the first to increase the income tax threshold; and presently, persons earning less than $29,000 per year are exempted. It shouldn’t surprise anyone that there are people who want income tax to be abolished, and that the majority of those who clamor for that, if not all, are persons whose earnings are above the threshold. A brother named Horace Palacio is the latest to add his voice against income tax. You can bet the house that his income is above the threshold. Palacio made his case in an article on BBN (BelizeBreakingNews), and it carried a disclaimer.

In his very persuasive piece, “No more punishing hard work: It’s time to end income tax in Belize”, Palacio said, “For Belize to unlock its true economic potential, bold reforms must be considered — and one of the boldest would be the elimination of personal income tax.” He said that at the beginning there’d be some challenges, but “with the right adjustments, eliminating income tax could unleash economic growth, create thousands of jobs, and even increase total government revenue through smarter, more dynamic systems.” He said income tax is “inefficient and counterproductive;” it “taxes productivity, punishes work, and discourages entrepreneurship”; and “worse, it often burdens the middle class and small businesses while leaving wealthier corporations and elites plenty of loopholes to exploit. It is a tax that generates resentment rather than national growth.”

The gentleman, Mr. Palacio, it looks like he has much expertise in the field. Bully for him, but that’s where I stop. I’m not on his page. You could call me biased, because I live well below the income tax threshold; and yes, I’d probably be not so happy too if I was over the threshold and had to pay. For sure you could pin me if you wanted to roll that way. You could also hold an open position until we are through here. If we recall the old TD4 income tax form, from a time when we lived in the social-justice mixed economy, there were basic reliefs for children, other dependents, children’s education, and investment in charities. The more people your earnings supported, and the more support you gave to charities, the less taxable income you had. The way that looks to me, the system encouraged families to have children, and people to put money into worthy causes.

A forever cry against income tax is that the rich, assisted by their accountants, know how to dodge taxes on income. But if the rich were so adept at escaping income tax, why is it that in the US they invest so much in politicians who push the abolishing of income tax? Tooth and nail, the Republican Party, which controls government in that country 50% of the time, fights to abolish income tax, fights social security, fights subsidized medical care.

I don’t know where Mr. Palacio fits in our economy, but on this income tax, I think those of us who are employees shouldn’t talk too loudly. The capitalist system doesn’t encourage employees. The emphasis is on people who invest and create jobs, create employees who pay income tax. Bah, employees don’t want to pay income tax because the rich find loopholes!

Too many people are against income tax. What is it with man to think they are an island? It’s not all about you; there’s we too, us, how we make the system work for everyone. Bah, there are people in Belize who are more capitalist than the people who invented the system. It is that everyone lobbies for their bracket, but people who succeed in the system need to recognize what they owe to it. All of us don’t fit in, but it draws from all of us. The GST, fuel tax, and other taxes paid by those of us who are below the threshold, help pay the salaries of those in the public sector who are above the threshold, and make up the gross sales of companies/businesses that hire people who make more than the threshold. Without the “poor” there’d be no “rich.”

The Europeans who invented the system (not the Americans) have a proper understanding of how things work. Statista says, “As of 2023, the average taxation rate for a single person without children who earned an average salary in the European Union was 29.67 percent of their total earnings. For a two-earner couple without children earning an average salary, it was slightly less, at 29.57 percent, while for a single person without children earning 1.67 times the average salary, the rate of taxation in the EU was 35.16%. Having children greatly reduced the average rate of taxation, with a one-earner couple with two children in the EU only paying out 15.97 percent of their gross household earnings in taxes in 2023. Tax rates in Europe are generally quite high, due to the progressive income tax systems set in place during the 20th century in many countries, which require high taxation in order to fund generous social welfare systems.”

According to an AI Overview, “The 10 happiest countries in the world for 2024, according to the World Happiness Report, are: Finland, Denmark, Iceland, Sweden, Netherlands, Costa Rica, Norway, Israel, Luxembourg, and Mexico. These countries consistently rank high in terms of life evaluations, social support, and other factors related to well-being.” We know the European way; there’s no surprise there; well, Israel, Mexico, and Costa Rica all tax income too. I am tempted to say something else makes Israel happy, but that murderous streak, I think it is only a small group that is getting satisfaction from the horrors they are doing in Gaza.

That happiness gauge can’t be entirely accurate, but it is logical that the happiest countries are ones where the state ensures that the needs of the people are met. In the vicious capitalist state, where everything is about money, the rat race and survival, you don’t need a survey to prove that the stress level is high. The US is 23rd on the happiness list in 2025, despite being the world’s richest country. If they abolish income tax and their social programs, they’ll be slipping down, not climbing up that happiness ladder.

A 2018 Central Bank paper said 9.2% of our tax earnings come from income tax, and it certainly looks possible that government could make it up with another system. However, there are things about income tax that have implications beyond dollars and cents. Of course, we can end this discussion altogether: let’s go full-blown socialist, let everybody tek care of everybody. Abolish income tax, and the cold capitalism moves from the chiller to the freezer. Leave income tax alone.