BELIZE CITY, Wed. Mar. 18, 2015–The Government of Belize and the Belize Bank have been in court since 2014 in an attempt to settle a $30 million tax dispute arising out of a tax assessment handed down by Income Tax Commissioner Kent Clare back in 2013.

Court documents reveal that the dispute was over assessments spanning 2000 to 2005, for taxes which the Belize Bank claimed it did not owe, because its bills had been settled by direct payments as well as a set-off that had been arranged with the Government of Belize.

Although the Belize Bank challenged the assessments, the Income and Business Tax Act (IBTA, Section 53.2 and 53.3) contains a provision which says that despite the challenge put forth by the bank, it was liable to pay the full sum assessed.

In a recent ruling handed down by Supreme Court Justice Courtney A. Abel, the court determined that the provision breaches the Belize Constitution, and Abel applied a “blue pencil” measure to strike out what he called the offending provisions in the law.

Clare, who is the second defendant in the case, had issued demand notices dated August 13, 2013, to the Belize Bank totaling BZ$30,534,849.11; however, the court found that the assessment was excessive, and reduced it instead to BZ$12,569,624.35. After applying a credit for BZ$3,082,254.01 paid to the Income Tax Department in October 2006, the court declared that the balance of the Belize Bank’s tax debt is now BZ$9,487,370.31.

Abel found that the set-off which the Belize Bank has claimed in settlement of its tax debt could not be applied, in light of a ruling handed down by the Caribbean Court of Justice (CCJ) in appeal CV 7 of 2012 – a case between the BCB Holdings Limited & The Belize Bank Limited and the AG of Belize, regarding the enforcement of an arbitration award and the legitimacy of the settlement deed, under which the Belize Bank claims the tax set-off.

Abel said that, “The upshot of CV 7 of 2012 is that the [Government and the Commissioner of Income Tax] are alleging that the settlement deed is invalid and that [they] are now free to collect the underpaid business taxes and surcharges contained in the demand notices…”

As noted in the Supreme Court decision, the CCJ had found that the implementation of the provisions of the settlement deed—without legislative approval and without the intention on the part of its makers to seek such approval—is indeed repugnant to the established legal order of Belize.

The judge ruled that “…for the reason given by the CCJ in its very careful and deliberate decision, the deed is indeed unconstitutional, void, and completely contrary to public policy and as such illegal;” and that the deed “was ineffective or unsuccessful in discharging or satisfying the tax debt.”

He also declared that, “The sum BZ$9,487,370.31 which is due to [the Government and the Commissioner of Income Tax] on the facts of the present case, are not statute-barred and shall be paid by the [Belize Bank] to the [Government and Commissioner of Income Tax].”

Abel’s “blue pencil” of the IBTA struck out a part of Section 53.2 and all of 53.3, as follows:

“(2) A notice of a review or an objection or an appeal against the assessment made by the Commissioner shall not result in the suspension of such assessment, and the entire tax due as determined by the Commissioner shall be payable before any such review, objection or appeal is entertained.

(3) The Chief Collector shall in every case enforce payment of the tax as assessed by the Commissioner irrespective of any pending review, objection or appeal.”

Justice Abel said that, “The above surgical excision is sufficient to remove the repugnancy in order, if possible, to preserve that which is not, and the constitutional defect can be remedied merely by a surgical removal of the offending part without striking down the entire law… Parliament can have another go at amending the legislation, if it so desires.”

Abel added, though, that, “In my view, any further need of any ‘blue pencil’ is obviated and there is no further need for tinkering with the provisions of the IBTA to bring it in line with the Constitution.”

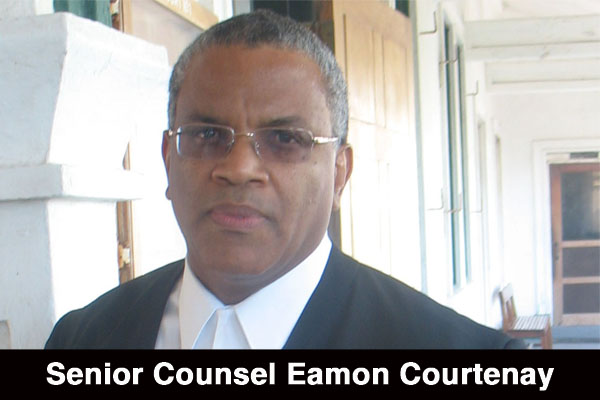

Eamon H. Courtenay, SC, and Pricilla Banner represented the Belize Bank, while Counsels Nigel Hawke and Magalie Perdomo of the Attorney General’s Ministry represented the Government of Belize.