“…a golden opportunity,” says SSB

BELIZE CITY, Thurs. Oct. 11, 2012

The Belize Electricity Limited (BEL) is facing stern opposition from Fortis Energy International (Belize) Inc., subsidiary of Fortis Inc. of Canada, in its latest attempt to raise an urgent $15 million in financing from the Belize Social Security Board (SSB), which has agreed to invest $10 million in preference shares redeemable in three years at a rate of 5% and $5 million in debentures which would earn 7% annually—much better than what SSB said the earmarked funds are now earning in the commercial banks.

Last Thursday, two days before SSB’s investment committee voted on the proposal, Fortis, represented by Eamon Courtenay, SC, had already filed a motion in the Court of Appeal seeking to block BEL’s attempt to raise any new debt and issue any new shares.

As a part of its case to challenge the June 2011 nationalization of the BEL, filed against the Government of Belize, Fortis is now seeking an injunction from the Court of Appeal to stop BEL from acquiring the new debentures and issuing the preference shares. The case is slated for hearing sometime next week.

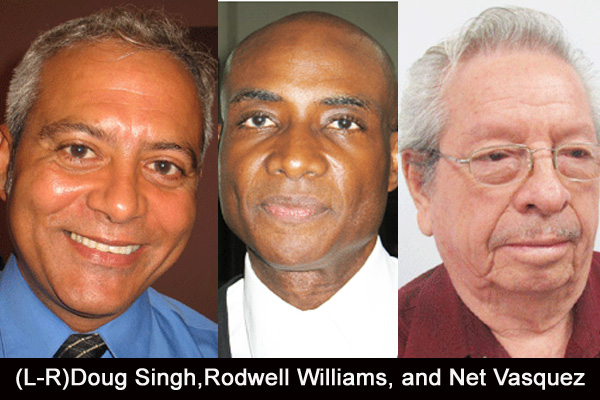

Meanwhile, BEL still hopes to proceed with the debenture offering: “We want to release the prospectus and begin the offering before the end of the month,” Rodwell Williams, chairman of BEL, told Amandala today.

BEL has said that it will up the $17 million offered in Series 1 to $25 million in the new Series 5 issue. Due to a general decline in interest rates on the deposits, the debentures will pay 7%, down from the 12% offered in the first issue.

“A current challenge facing the company is high cost of power, which started in July 2012, and has put a strain on the company’s cash flow since September 2012,” said BEL in a press release issued on Wednesday, October 10, 2012.

BEL added that “…it is prudent for BEL to secure access to funding, whether from shareholders and/or lending institutions, in order to be able to absorb spikes in electricity cost until the next ARP [Annual Review Proceedings by the Public Utilities Commission].”

According to Williams, BEL is currently getting “opportunity” power from Mexico, which costs 42 cents per kwh, while customers are being charged 26 cents based on the regulated cost of power. BEL has had to absorb the difference.

Every in-country source of power is not performing, Williams told Amandala. He said that Hydro Maya, a small plant in southern Belize, is out of commission; BECOL, which gives a rate as low as 5 cents per kwh, does not have enough water to produce power and has been underperforming since June; and BELCOGEN (the bagasse plant operated by the Belize Sugar Industries) has mountains of bagasse that it says are no good to fire their plant and new bagasse won’t be available until the next crop comes in this November. This leaves only the very expensive gas turbine owned by BEL. Due to these irregularities, said Williams, BEL has had to purchase more Mexican power – which has come at a higher cost.

BECOL’s operations manager, Wayne Cadle, confirmed to our newspaper that they are currently under-producing hydroelectricity—although it is far less than usual due to low water levels. Whereas they would produce up to 56 MW of hydropower at this time of the year, they are now down to 30 MW. BECOL operates three hydropower plants on the Macal, said Cadle.

Williams told us that over $30 million in credits earned by consumers and rebated by the PUC are being wiped out by the current power supply crisis, but saving on financing can help offset costs to consumers. The situation is also wiping out BEL’s liquidity, said Williams.

As nationalists running the company, he said, they have to get the best rate.

He explained that the cost of financing is also passed through to customers on their light bills, and the less they pay for financing, the less the cost to consumers. He also said that reducing BEL’s debt service obligations would enhance the value of shares held by investors – which include the Government of Belize, the SSB and 1,500 minority shareholders.

All the banks have expressed their willingness to take up debentures from BEL, said Williams.

According to chairman of the SSB’s investment committee, Net Vasquez, the decision made by the SSB on Saturday, to invest $15 million in BEL, is based entirely on the fact that it is “a golden opportunity.”

“We have about $150 million available. We have $26 million of that $150 million that is only earning between 1.25% and 2%. Therefore, if we lend [it to BEL] for 7% … that is a big gain that we get,” Vasquez told Amandala.

“We can no longer get 7% from the banks,” added Vasquez, estimating that the new debenture series would run about 12 years.

According to Singh, SSB’s chairman, the CDs or term deposits that are earning around 7% at the banks won’t be renewed at the same rate. He said that banks have already indicated that the interest rate would be slashed to about 3.75% and no new cash would be taken for term deposits, he said.

“BEL has shown a very good history in paying its debt,” said Singh, adding that BEL is taking advantage of the opportunity presented and seeking to refinance and cut interest rates, which will cause interest payments to drop from $13 mil in 2011 to under $5 million in 2012. He said that the company is also projecting a 500% increase in net profit for the current financial year.

All this, said Singh, benefits SSB, which owns almost 27% of BEL. BEL would gain either by receiving cash dividends or equity appreciation, said Singh, calling it “a win-win situation.”

Amandala asked Singh how the vote went when the board of directors of the SSB met on Monday. He told us that he and the four government directors voted in favor of the investment in BEL; however, the two private sector directors and the one union director present abstained, mostly indicating that whereas they personally thought the BEL offer to be good, they had not consulted with their memberships on how to vote.

According to Singh, BEL and SSB had been discussing the proposal for months, but no concrete details were available until late last week, when the prospectus and the internal analysis and recommendations of the SSB were available.

No one voted against the proposed investment in BEL, Singh indicated.

BEL is also offering the $10 mil worth of SSB preference shares at a rate of 5% yearly. SSB currently owns 26.9% of BEL.

“Both of those rates are far better than where we are,” said Vasquez.

He told us that about 15 years ago, in the late 90s, SSB had invested in the debentures due to mature this December, and it also intends to reinvest those funds in the Series 5 debentures.

“What else is available?” Vasquez questioned.

He noted that back in October 2010, the SSB made a decision to invest $50 million in BTL shares. Vasquez said that that the BTL shares are to date the best performing SSB investment, yielding returns as high as 12%.

He told us that “…$25 million of that $50 million was only earning 1% at the Central Bank.”

Apart from the financial motivation for investing in BEL, Vasquez also pointed out that, “BEL has to survive and continue to give services [to the nation].” He said that by virtue of existing constitutional provisions, Government will always be in control of the company and the “good investment” SSB is making in BEL would continue to perform.

He confirmed that the board of directors of SSB voted in favor of the investment when they met on Monday at a regularly scheduled meeting.

“What we have announced is that the procedure requires the Social Security Board to ‘gazette’ the proposal twice and to publish it in a newspaper,” Vasquez explained. He said that the funds won’t be disbursed until two weeks from now, when that process is complete.

BEL has indicated that the financing proposals outlined in its 2012–2016 business plan said, “As a first option, we will be approaching the Social Security Board to purchase preference shares in the company… The order of preference [of the funding options under consideration] is in line with risk associated with achieving the lowest rate possible.”

“The Series 5 debenture offer will be opened later in October 2012 and will close in December 2012,” said a statement from BEL.

According to Williams, the SSB’s investment in preference shares will be secured with assets, which will include the Magazine Road substation and possibly the Northern Highway headquarters.

BEL has issued four prior debenture series, cumulatively valued at just under $70 million. The Series 1 debentures valued at $17 million (12,391 unsecured debentures at $76 and $160,065 unsecured debentures valued at $100) matures at the end of the year, on December 31, 2012.

In its 2011 annual report, BEL had indicated that it would seek to refinance the Series 1 debenture.

“With high market liquidity,” said BEL, “we are confident that we will be able to secure financing at lower interest rates.”

Williams said that BEL has never missed a payment on its debentures. He said that because of the current situation, BEL needs to re-profile its debt and it will do so by floating debentures to capitalize on the opportunity that the market now gives them to refinance.

When the SSB reversed its decision last June, around the time of the BEL acquisition, to lend $14.9 million to the Mena family’s Nature Catch shrimp facility, Prime Minister Dean Barrow had signaled to the media that an investment could, instead, be made in BEL.

At the time SSB’s investment committee recommended the loan to the Menas, it had likewise complained of low returns on its cash deposits at the commercial banks. However, public outcry led to the SSB’s abandonment of that offer.

As for public feedback on this new proposal, Vasquez said that the calls he has received in response to the announcement that SSB plans to invest $15 million in BEL have been “quite favorable.” One of the questions raised at yesterday’s press conference, said Vasquez, is why BEL seems to be in a hurry to raise the debentures.

“As far as I am concerned, it is a golden opportunity,” Vasquez reiterated.