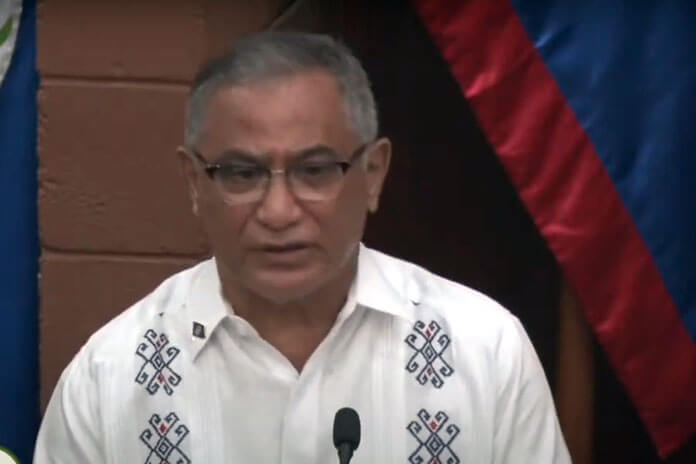

BELMOPAN, Mon. Apr. 12, 2021– On Friday, the Draft Estimates of Revenues and Expenditure for the Fiscal Year 2021-2022 was presented by Prime Minister John Briceño. The PM delivered the national budget using a teleprompter, a first for the House of Representatives. His budget, titled “Today’s Sacrifice: Tomorrow’s Triumph!” outlined his government’s goals to address the economic crisis gripping the country.

“That this Budget presentation comes at a juncture of unparalleled national crisis is indisputable. Belize is facing her most severe economic, fiscal, and debt crisis,” PM Briceño said.

According to Briceño and his government, the economic fallout, which was propelled by the COVID-19 pandemic, was largely fueled by the almost 13 years of reckless spending by the UDP’s Barrow administration.

This budget presentation was pushed back to allow the Government and public sector unions to engage in a series of consultations in an effort to reach some agreement on cost-cutting measures that could be implemented in an effort to address a severe fiscal imbalance. The government ultimately proposed a 10% salary cut as one of the several cost-saving measures to be included in the budget for the 2021-2021 fiscal year.

“I acknowledge the Belize Chamber of Commerce and Industry, the Belize Business Bureau, the Council of Churches and the NGO community. I applaud the Joint Unions for their extensive contributions as well as those many public officers whose execution of their duties had an impact in ways small and large upon the participatory exercise of composing this budget,” said Prime Minister Briceño at the start of his presentation.

The pushback from the unions has been constant, and none of the unions that were part of the negotiating team that participated in the budget consultations have agreed to the salary cuts, which are projected to yield 240 million dollars in savings over a three-year time span.

On Wednesday, Briceño announced that his government would nonetheless proceed with the salary cuts, which will affect public workers who receive a salary of more than $250 weekly. According to Briceño, public workers who collect an annual salary of $12,000 will not be affected by the salary cuts. (The government is expecting industrial action by the unions in response to these measures.)

During his budget speech, the Prime Minister, prior to outlining other cost-saving measures being put in place by the government, said, “the salary adjustment is necessary, but it is no fiscal elixir; that alone is far from sufficient to reverse the public finance morass left behind by the last UDP Administration. Painful as it surely is, the $60 million in salary adjustments and the $20 million foregone for increments and allowances in this Budget is one step in the hard slog back to fiscal fitness.”

The PM stated during the address that overall the Gross Domestic Product declined by 14%, with the revenue generated by the tourism sector falling by 60%.

Total revenue and grants fell by 28%, Hon. Briceño went on to say, and he pointed out that, for every dollar Government expected to receive, it only collected 72 cents. The amount it received through the collection of GST fell by 32% and the revenue collected in the form of license fees fell by 52%.

While spending also fell, the amount by which spending was reduced, lagged behind the 28% fall in revenue. Total spending fell by 15% over the previous fiscal year. PM Briceño went on to note that spending on Goods and Services has been reduced by 31%; the amount spent on pensions fell by 14%; the outlay for Subsidiaries and Transfers was reduced by 31 %, and the amount spent to service our debts to creditors was cut by 54 %.

“This decrease in debt service spending, the most substantial reduction, reflects the capitalization of the Superbond coupon payments which was agreed to by bondholders in August of 2020,” the PM said.

Prime Minister Briceño then went on to give an update on the issue of the national debt. He outlined that the country, at this time, has amassed an overall public debt of 4.2 billion dollars. In essence, he explained, every Belizean man, woman, and child has a $10,000 debt bill tagged to them. Each family of five owes $50,000.

At this time the public debt is 130% of the country’s annual economic output, making us the 6th most indebted country in the world — with only Japan, Greece, Venezuela, Sudan, and Lebanon having a higher debt ratio than we do, according to the PM.

He then proceeded to break down the public debt in some detail. At this time the country owes bilateral lenders $872 million, according to the Prime Minister. A total of 55% of this debt is owed to Venezuela, for the Petro Caribe Program. The next 34% of that debt is owed to Taiwan and other partner nations.

The country owes the IDB and CBD a total of 36% of the $794 million owed to multilateral lenders. An additional 17% is owed to OPEC and 7% to the World Bank. The balance is owed to other IFI’s.

One of the largest debts the country is saddled with is the Super-bond. That Super-bond debt constitutes 97% of the $1.168 billion owed to external creditors. An additional $60 million debt represents a US dollar bond issued by the Central Bank back in 2020 amid the first waves of the COVID-19 pandemic.

The country also owes domestic creditors to the tune of $1.35 billion, with the Central Bank being owed 41% of that debt, or 561 million dollars.

Hon. Briceño shared that around two-thirds of the country’s public debt consists of external loans that must be repaid in foreign currency.

He said that his government plans to reduce the debt-to-GDP ratio to 85% by 2025, the end of their 5-year term, and below 70% by 2030 if they are reelected. “This means borrowing less each year, starting now,” he said. A reduction of almost 2% of GDP is thus recorded in the overall financing of this year’s budget.

He additionally stated that his government will take a four-step approach to realizing the goal to achieve fiscal balance for the country within the allotted timeframe — with the first step being the mobilization of the Debt Management Unit.

The estimates for the 2021- 2022 budget are as follows: The government has projected that it will collect $965,459,974 in recurrent revenue. Of that amount, $884,421,460 is expected to be tax revenue. Non-Tax revenue is projected to be $81,038,514. Capital revenue generated from the sale of equity and crown lands is expected to amount to $5,366,399 and Grants are expected to total $67,361,478. In total, the 2021-2022 budget estimates $1.038 billion in total revenue and grants.

In regards to total projected spending, the overall expenditure for this fiscal year 2021-2022 is expected to total 1.204 billion dollars. Recurrent spending represents the majority of this sum— $905.9 million; while capital spending, at 298.6 million dollars, represents the balance. The overall deficit is $166,317,992, or 4.93% of GDP. Also tacked on to the total expenditure is the cost amortization, a total of $109,368,220. Financing of $275,686,212, or 8.4% of GDP, is needed to meet this year’s budget.

The budget projects that approximately 64 cents of each dollar will be spent on salaries for public workers. The government will use the remaining 36% to cover other daily expenses and make interest payments on the 4.2 billion dollar debt, said Briceño during his presentation.

According to the Prime Minister, other areas of capital spending outlined in the budget include:

$15 million for the national response to the Covid-19 pandemic, including testing, personal protective gear, critical care supplies etc.

$10 million for 238,800 additional vaccines to be acquired on discounted terms through the COVAX facility

$3 million for the ongoing food assistance program

$60 million for the Coastal and Caracol Highways

$3.5 million for new housing programs and low-cost housing support (which, he said, is in partial fulfillment of PlanBelize)

$3 million for improvements to sugar roads and other agricultural roads

$18 million for the ongoing restoration of the Phillip Goldson Highway

$16.5 million, combined, for improving education quality and delivery and for Digi-Learn

$5 million for upgrading of streets and drains nationally, with special allocations for rural and village roads

$12 million for climate-vulnerability-reduction initiatives

$17.5 million for ongoing restoration of the George Price Highway

$5.5 million for community-based projects executed by SIF and BNTF, to improve rural living

$6 million for various national security initiatives, as well as for road safety programs

$7 million for improvement to the tax collection system so that tax evasion and underpayments can be substantially reduced

$4.0 million to extend the Solid Waste Management Network

$4.6 million for the new passport system

The budget debate is scheduled for the 22nd and 23rd of April.