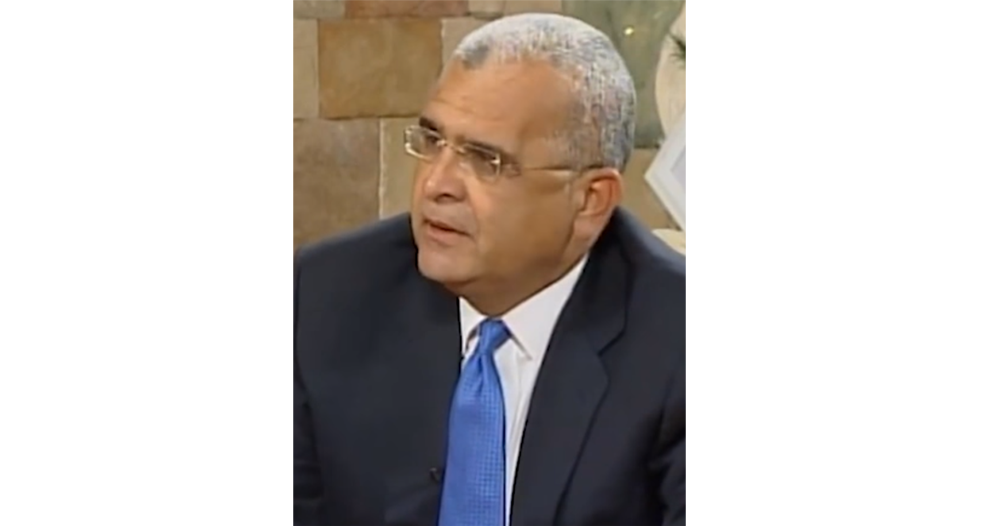

Photo: Martin Marshalleck, Administrator for St. Francis Xavier Credit Union

by Kristen Ku

BELIZE CITY, Mon. Mar. 13, 2023

Following his recent appointment as the new chairman of the Karl Heusner Memorial Hospital Authority (KHMHA), Martin Marshalleck is once again making headlines.

On Friday of last week, the Central Bank called a press conference, announcing that Martin Marshalleck is the new administrator of St. Francis Xavier Credit Union, located in Corozal.

The news comes after the long-standing issues within St. Francis Xavier’s administration, including the previous board’s decision to deny renewal of the contract of the general manager, Rafael Dominguez, Sr., as well as certain actions taken against members and staff that were seen as unfair and abusive.

Subsequently, allegations of embezzlement, physical attacks, and protests were reported to have taken place, in response to the perceived “injustice” in the change of manager.

Unfortunately, these activities have tainted the reputation of the financial institution’s management and in the most recent development, have also tainted the accountability of the administration.

Marshalleck, a career banker, accepted the appointment as the institution’s new administrator after the close examination of the credit union’s operation revealed poor governance in terms of unaccountability at the management level.

The Central Bank Governor and Credit Unions Registrar, Kareem Michael, explained that apart from the examination, a regime of enhanced supervision was also conducted, enabling onsite examiners to review the day-to-day operations at the credit union.

Unfortunately, both exams resulted in an outstanding lack of action by the board in upholding their fiduciary responsibility under the Credit Union Act that directs proper management of risks and the establishment of cooperative values and conduct.

As this puts at risk the stability of the credit union, Michael explained why the decision to appoint an administrator was important.

“The board’s noncommittal responses to address the grave issues uncovered during onsite examinations are strong indicators that the board is not equipped or disposed to discharge its fiduciary responsibilities to members and depositors of the credit union. The culture of unaccountability at the management level continues to result in subjective decision-making and self-dealing practices while discounting the risk and potential losses to the credit union. The committees are ineffective in their roles of managing credit and in providing unbiased objective reviews of Saint Francis Xavier Credit Union’s risk management, governance, and internal controls process. For these reasons, I have concluded that the appointment of an administrator is required to protect the equities and interests of the member-owners of Saint Francis Credit Union,” he stated.

As the current administrator of St. Francis Xavier, Marshalleck will answer directly to the Registrar, following directions and instructions in the interest of the credit union as requested.

In regards to the directors and managers of the credit union, Michael added that for the time being or until management resumes operations, they no longer hold any power unless instructed by the Administrator.

“We are guided by the provisions of the Credit Union Act which provide that the directors, officers and the managers of the credit union shall not exercise any of the powers conferred upon them by this act or bylaws during the time that the administrator remains in charge of the conduct of the business of the credit union. The said duties and responsibilities shall be performed by the administrator. Provided that, the administrator may delegate to directors, officers, or the managers specific duties as may be necessary to efficiently carry out the business of the credit union,” he said.

This decision to hand over all authority to an administrator does not imply any grave impact on members of the credit union.

However, following the transfer of authority to the administrator, SFXCU sent out an immediate press release on March 11, expressing its discontent with the Registrar’s decision.

The most upsetting point for them was the suspension of the duties of the Board, committees, and employees.

Among its gripes, the release claims that “The Registrar of Credit Unions who is also the Governor of Central Bank, took decision to violate the rights of each and every registered member who are the sole owners with authority to the administration of their business with the SFXCU.”

However, the release fell short of challenging the authority of the Registrar to appoint an administrator as provided for in the Credit Union Act.

And while the release argues that there was “no justifiable reasons for his actions”, and “therefore indulge the Registrar to reconsider his wrongful approach,” it nevertheless concedes that “the current administration continues to comply in every way possible to the demands of corrective measures indicated by the Central Bank of Belize.”