BELIZE CITY, Fri. Oct. 21, 2016–As of 8:30 this morning, commercial banks in Belize began to operate the newly launched Automated Payment and Securities Settlement System (APSSS or APS3 for short), which means that customers are now able to send funds instantly from their commercial bank to an unrelated commercial bank, cutting back on the waiting period that could span as many as 7 days.

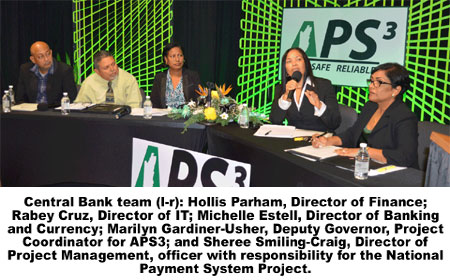

Sheree Smiling-Craig, Director of Project Management at the Central Bank of Belize, the officer with responsibility for the National Payment System Project, said at the formal launch held at the Central Bank’s conference room this morning that the system is safe and reliable, and it will mean faster payroll processing as well as new business opportunities for banks.

Central Bank Governor, Joy Grant, said that millions of dollars have been invested in equipment, as well as staff time. “But to echo what the chairman said, it’s not a choice,” she added.

We asked what level of investment had been made to bring the APS3 online, and while the parties declined to disclose the dollar figure, John Mencias, chairman of the Central Bank, said: “…the cost is, if we do not do it, we will be left out of the game, so we simply have to bear whatever cost it takes to remain in the game.”

Grant, Mencias and the Central Bank team recognized former Central Bank Governor, Glenford Ysaguirre, under whose tenure the project, which spanned 6 years, was developed. (Ysaguirre was not at the event.)

“We have to move into the future, and to do that we have to make sure that we have the systems in place. For example, if you were waiting for 5 to 7 days to get funds in your account and you now could get it in one day. That means that you could do more with that money over time,” Grant told the press.

Marilyn Gardiner-Usher, Deputy Governor and Project Coordinator for APS3, told the press that the establishment of the national payment system, under which the APS3 is being launched, is aimed at modernizing the banking sector. One of the aims is to reduce the use of checks in Belize. Meanwhile, the system would expedite check processing, reducing the waiting period to a day, regardless of the domestic bank upon which the check is drawn.

Gardiner-Usher emphasized that the reform only applies to domestic transactions—not transactions between local and foreign banks.

Hollis Parham, Director of Finance, described the new operations as a kind of 7-11 in banking, where customers can now move money via instant funds transfer 24 hours a day, 7 days a week. Businesses can also see efficiencies, since they don’t need to have bank accounts in many banks, he explained.

Rabey Cruz, Director of Information Technology, said that as of last night, banks started to bring the system online, aiming to be functional at the start of the business day Friday, and there are some who have also started to modify their website interfaces to enable customers to access quicker services via their internet and mobile platforms.

Cruz said that they have done exhaustive testing ahead of the launch. A backup system has been set up in Belmopan to help ensure continued access to the system.

Gardiner-Usher said that over the next 6 months, they will monitor how the system works before a decision is made on what would be charged to recover costs.

She urges Belizeans to use the newly launched APS3 system to make expedited transfers, such as opting for electronic fund transfer services in place of checks. While instant fund transfers can now be done via most commercial banks, Scotiabank is not yet online, Gardiner-Usher explained.

There are further reforms in the works as well. One of the changes being considered is a response to the derisking phenomenon. Gardiner-Usher explained that currently, Belize relies on the Visa credit card network to conduct domestic transactions, and if we were not able to use that system anymore, using payment cards would be disrupted. Therefore, they plan to look at the feasibility of a payment card switch to a system that will be linked to Belize’s national payment system.