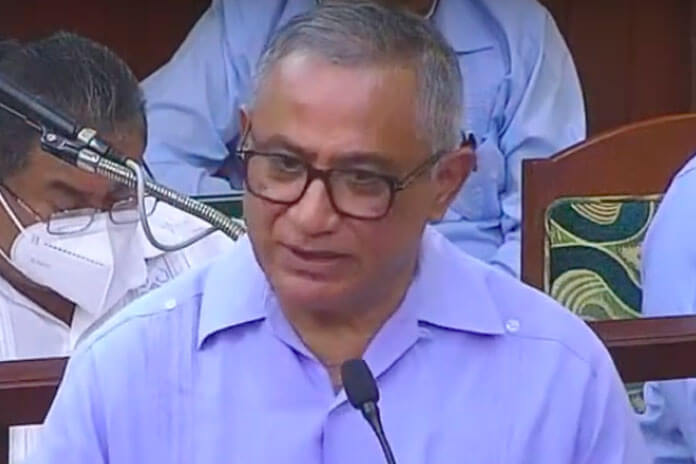

BELIZE CITY, Wed. Mar. 16, 2022– In an almost two-hour-long presentation in the House of Representatives on Tuesday, Prime Minister Hon. John Briceno outlined specific aspects of the General Revenue Appropriation Bill (the budget) for 2022-2023 and reflected on the above-average performance of the economy over the past year—highlighting a marked economic rebound, but warning of dark clouds on the horizon.

“My report today will show that our first Budget exceeded all performance markers and that the new Budget, proposed at $1.361 billion, will be the largest spending and investment Budget in the history of our country,” Hon. Briceño noted in his presentation.

But the government must remain cautious from both a revenue and spending standpoint, said the Prime Minister. The total revenue and grants to be received by GoB is projected in the new budget to be $1.26 billion, with a recurrent revenue of $1.22 billion—about 7.5% more than what was projected in the 2021 budget, which saw a 19% increase in the amount of funds entering the country’s coffers due to an additional $50 million in grants and $5.36 million in capital revenue—resulting in total revenue and grants of $1.192 billion for that period.

Notably, however, although the 2021-2022 budget was presented as one of austerity, the government’s spending surpassed the $1.217 billion that had been budgeted for expenditure by $14 million.

Prime Minister Briceño acknowledged this excess spending during his budget presentation, and remarked, “Now the excess spending in the instance of Goods and Services is the item of greatest concern to me: $50m or some 29 percent higher than the Budget. While we concede that the cut for FY 2021/22 was significant, compared to previous years, there must be an acceptance that spending 20 cents of every dollar collected by Government on Goods & Services is intolerably high.”

He added, “The Ministry of Finance will redouble efforts to suppress this expenditure line item but to do so requires an all-of-government approach. I appeal to Ministries and Financial Officers to exercise maximum restraint.”

In the upcoming financial year, overall spending is expected to increase by $144 million or 12%, to $1.36 billion. This will include the 10% of public workers’ and teachers’ salaries that had been deducted from what they received over the past year as a cost-saving measure but will be paid once more to those workers following the reinstatement of their full salaries.

“The decision to restore, in dollar terms, translates into an additional $40 million in the Personal Emoluments and $15 million in the Subsidies and Transfer line, for a total of $55 million,” the Prime Minister said. He also noted that this year $101 million will be allocated for pension payments.

“Taken all together, wages and pensions, including the wage-related subsidies categorized as Subsidies and Transfers, will total some $704 million. Let me repeat, for necessary emphasis that stunning figure: Wages, wage-related subsidies, and pensions will cost Government $704 million in the coming Budget year. 62 cents of every dollar Government collects in recurrent revenues will therefore be spent on wages and pensions,” said Hon. Briceño.

The overall deficit of $97.6 million will be bridged through grant funding from Taiwan, which is categorized as Capital 3 funding (loans from external sources), and the issuing of treasury bills, explained Hon. Briceño. In response to questions about the high overall deficit in this budget, he said, ”The point is, we are bridging the deficit, and the way we are bridging the deficit is, one, by grants, which our good friends from Taiwan are helping us with some grants, and secondly from the Cap 3 funding when the US comes in, and then we will also be issuing some treasury notes and bills. Between those three factors, we will be able to close the deficit.”

According to the International Monetary Fund, Belize’s economy is estimated to expand by 6.5% this year — but despite the upswing of 2021, which saw global world input increase by 5.9% and a 12.5% economic expansion in Belize, the world (including Belize) is headed for tougher times, cautioned Hon. Briceño.

In outlining what economic prospects lie ahead for 2022, the Prime Minister stated, “The global growth momentum observed in 2021 is expected to recede in 2022. According to the IMF, global growth is expected to weaken by 1.5 percentage points to 4.4 percent in 2022.”

Despite GoB’s anticipation of a global economic downturn, however, no new major tax or revenue-collection measures were included in the new budget—notwithstanding the fact that the four major categories of taxes together constitute the primary portion of what GoB collects in recurrent revenue, with taxes on goods and services estimated at $654,966,339 for this coming fiscal year (over half a billion dollars for the Belizean taxpayer).

The government is, however, providing funding to bolster the new Tax Recovery Unit.

“Cabinet committed to establishing a Tax Recovery Unit. This Unit began operations in October of last year. With help from CARTAC, the Unit reviewed the 18,830 accounts that carried nominal arrears of some $645 million and relating to the Belize Tax Service Department (that is, the GST, Business Tax, and the PAYE levies). Of this $645 million: only 6 percent or $38 million were assessed within the last two years; less than 20 percent or $111 million are less than 5 years in arrears; approximately $419 million or 67 percent are noncollectable by law due to the statute of limitations, or because they related to the now obsolete Sales Tax,” stated the PM during his presentation of the budget.

While the International Monetary Fund’s (IMF) fiscal affairs department has deemed taxes that have been outstanding for more than three years to be uncollectable, however, the Leader of the Opposition, Hon. Moses “Shyne” Barrow, stated during his remarks in the House that a bill should be brought to the House to extend the statute of limitation on recovery of uncollected taxes.

“There are creative ways to make it where we can get the money, get people to pay what they owe the Belizean taxpayers … we have come to this honorable House and presented legislation to remedy problems that did not exist, so with a problem such as this I believe the entire country would rally behind the government to bring legislation where we can get people to pay what they owe. The statute of limitation should not be used for absconders of tax dollars that are owed to the Belizean people,” said Hon. Barrow.

Increased collection of taxes could be of assistance to the country as it services its debt portfolio and inches toward reducing its 108% debt-to-GDP ratio. Last year, $86.4 million of public debt was retired, separate from the write-off related to the Blue Bond payout of the Superbond.

“According to the IMF’s most recent assessment, issued on 24th February 2022, Belize’s public debt fell from 133 percent of GDP at the close of 2020 to 108 percent at the close of 2021, down by a massive 25 percent of GDP,” the PM stated in his budget presentation.

During an interview following the House meeting, the PM Briceño told reporters that his administration is aiming to reduce the debt to GDP ratio to as low as 80% during their time in office.

“In the first year, we manage to reduce it by 25%. That does not mean we are out of the woods; we are still in dangerous territory. So our objective and goal is for us to reduce debt to GDP to 80% by 2025 and by 2030 we hope that the next government … will be able to reduce it to 70%,” he said.

Key sectors driving the economic rebound recorded in 2021 remain our traditional mainstays: agriculture and tourism. This budget, the PM says, has been proposed “to allow time for the economic recovery to solidify and for wage relief to offset rising inflation.”