The South American country will save over $1 billion as a result of the new agreement focused on the protection of the Galapagos archipelago

by Marco Lopez

BELIZE CITY, Wed. May 10, 2023

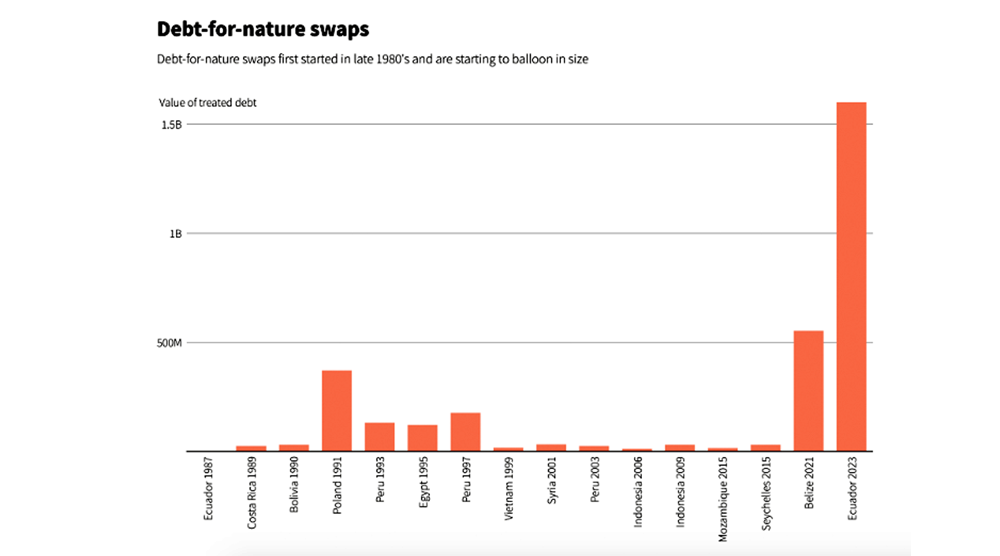

In 2021, Belize made international news after the finalization of our Blue Bond financing arrangement. At the time, that debt-for-nature deal, which was brokered by The Nature Conservancy, was the largest worldwide at US $364 million and established a blueprint for other deals to come. On Tuesday, Ecuador signed its own $656 million deal with the help of Credit Suisse to protect the Galapagos Islands. This most recent debt-for-nature agreement is now the largest of such deals to date.

The Galapagos Archipelago is a UNESCO World Heritage site and home of many unique species such as marine iguanas, giant tortoises, and Darwin’s finches, found only on the chain of islands. A total of $1.6 billion of the country’s debt was bought back by means of this deal. This equates to a nearly 60% discount for the country.

This deal has reportedly been in the making for 3 years and was executed at a time of political turmoil in the South American nation – as the National Assembly is seeking to impeach President Guillermo Lasso on embezzlement allegations which he vehemently denies. (Of note, yesterday, 88 National Assembly members voted to continue the impeachment of President Lasso.) The Foreign Minister of Ecuador shared that biodiversity is now a valuable currency.

The new deal covers a period that extends until 2041 and provide a 5.6% interest rate to investors. The country’s sovereign bonds currently yield between 17% and 26%. The new bond has an $85 million credit guarantee from the Inter-American Development Bank (IDB) and political risk insurance to the tune of $656 million from the US Development Finance Corp (DFC).

“Debt-for-nature swaps have proved successful in Belize, Barbados, and Seychelles in recent years, but Ecuador’s deal is by far the largest to date, cutting the country’s debt by over $1 billion once the $450 million of total conservation spending is taken into account,” an article from Reuters states.

The 600-mile chain of islands houses biodiversity not found in any other part of the world, and is considered one of the world’s most precious ecosystems. The biodiversity on the island is credited for having inspired Darwin’s Theory of Evolution.

The recent deal has opened a new chapter – one focused on the diligent protection of the Galapagos, the country’s most valuable biodiversity hotspot and tourist destination.

As a part of the deal, $12 million will be channeled for the protection of the islands, and $5 million will be put into a fund that should last decades. Director of the Pew Bertarelli Ocean Legacy, Giuseppe Di Carlo calls it an “extraordinary win” for the country.

Conservation funding in the area has already helped to revive local tuna and other fish stocks – but most fishing is currently taking place in unprohibited areas.

An 11,500-square-mile reserve between the Galapagos and the Costa Rican maritime border was established last year. This protects migratory sharks, whales, manta rays, and sea turtles which use the migratory corridor.

The Chief Executive of the US DFC says that people should “stay tuned” for similar debt-for-nature deals in other countries.

More and more indebted nations with critical natural resources are turning to this novel and innovative solution. While debt-for-nature swaps have been around since the 1980s, in 2015 Seychelles signed the first Blue Bond and was followed by Belize, which signed its deal in 2021. This Ecuador Galapagos Bond is the most recent of such deals executed.

The recent buyout of Credit Suisse by UBS in mid-March resulted in some delays in this deal which, as mentioned, has been in the pipeline for at least three years.