Photo: Kareem Micheal, Registrar of Credit Unions

Only one ground of the Fixed Date Claim brought by the former Board of Directors and General Manager of St. Francis Xavier Credit Union was granted – nine others failed

by Marco Lopez

BELIZE CITY, Mon. Apr. 15, 2024

Today, the High Court of Belize vindicated the Registrar of Credit Unions, Kareem Michael of the claims brought against him by the former Board of Directors, and the General Manager of St. Francis Xavier Credit Union (SFXCU), Rafael Dominguez, Sr.

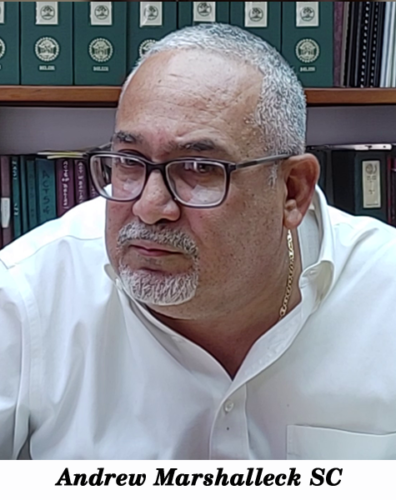

The claim arose out of the decision of the Registrar to appoint an administrator in the person of Martin Marshalleck to oversee and execute the salvaging of the second-largest credit union in Belize. This is according to the legal representative of the Registrar – Andrew Marshalleck.

Out of the ten grounds claimed by the former board members and general manager – only the decision made by Michael to levy a fine against the institution was struck down by the court – due to a procedural error on the part of the regulator.

The Credit Union Act empowers the Registrar of Credit Unions, who serves in his capacity as Governor of the Central Bank, with authority to intervene in the administration of the credit unions where deemed necessary.

An April 13, 2022 resolution which was passed unanimously, rejected the renewal of Dominguez’s contract. His son, Rafael Dominguez, Jr., and his common-law wife, Lina Garcia, who were branch managers at SFXCU Caye Caulker and San Pedro branches, respectively, were both fired as well.

However, by June 26, 2022, a new board, comprised of 7 of the claimants, was elected following an Annual General Meeting (AGM). They moved to reinstate Dominguez, Sr. and Jr. and the younger’s common-law spouse – Garcia.

This prompted the League of Credit Unions to write the Registrar requesting regulatory intervention into the affairs of the credit union. By June 28th, a letter was sent by Michael to SFXCU expressing concern over the reinstatements and subsequent suspension of 13 other employees of the credit union.

An audit report delivered on June 30, 2022, found, “significant deficiencies and material weaknesses in the credit union’s internal control over cash management, related party transactions, expenditure processing cycle, anti-money laundering, risk management and compliance and governance and oversight responsibilities.”

He directed the auditor to carry out a special examination under section 60(5) of the Credit Union Act. This was completed by August 12, 2022, and confirmed prior findings, that “significant deficiencies” were present in the operations of the credit union. These included “numerous breaches of policies, procedures, by-laws, and contraventions of the Credit Union Act,” according to the judgment.

The Registrar concluded that the weaknesses identified threatened the financial interest of the members of the credit union, and he met with leaders of the credit union to chart a path forward with clear timeframes. These were not complied with, and the credit union at one point requested an extension to implement the recommendations.

A February 24, 2023 letter from the Registrar indicated to the credit union that a fine of $2,000 was being levied against it for noncompliance with the directive. To the discontent of the board and former GM, the administrator was appointed shortly after this fine.

Attorney for the claimants, Dean Barrow SC argued that the Registrar acted beyond the scope of his power in the appointment of the administrator. He claimed that the state of the credit union was not dire, and as such did not warrant the regulatory intervention.

Barrow, in his arguments, referred to “personal hostility” on the part of the Registrar, and claimed that he was “flexing” in the appointment of the administrator – adding that Michael “disliked the entire control structure of the credit union and all those populating that structure. “

He added, “His appointment of an Administrator was the easiest way to supplant all those whom he saw as ‘undesirables,” according to the judgment.

Marshalleck, for his part, argued that the Credit Union Act provision to appoint the administrator was properly invoked. The burden of proof to show otherwise fell on the claimants, whose attorney failed to prove virtually all the grounds brought in the claim, all except the one imposition of the fine from the Registrar against the credit union.

The court found that the appointment of the administrator was reasonable – finding that the Registrar was entitled to invoke the act before the state of the financial institution diminished any further.

Questions of whether adequate consultation with the Credit Union League had taken place and a breach of natural justice were also struck down by the courts.

Of importance, the claimants failed to prove that the actions of the Registrar were motivated by hostility – allegations SC Marshalleck says were made without basis.

Ultimately, the court found that the actions taken by the Registrar were within the scope of his power and not excessive or disproportionate. These also included a directive to correct the loan portfolio of the Credit Union.

Marshalleck argued that urgent measures had to be taken to address the deficiencies found at the credit union, and as such, his client was well within the scope of his responsibilities to act.

“It’s easy for anybody to get up and make these allegations. In fact, it seems to me that it is the easier proposition to be challenging these administrative decisions. To complain about every step taken, and why they shouldn’t be taken, and to find one little mistake,” Marshalleck said.

He added, “They couldn’t find that in this case, so in the end [the] majority of it stands. The one issue they had was the circumstances in which that $2,000 penalty was imposed, and that has been quashed, so that has to be returned. But for the most part, 90% plus of it – yes, the Registrar positions has been vindicated.”

There have been no indications from the claimants whether or not they will appeal this decision handed down by High Court Judge, Martha Alexander.

The appointed administration of SFXCU is currently still ongoing.