Photo: Marlowe Neal, appointed receiver of Stake Bank Enterprise Limited

Feinstein Group asks for independent inspector of ABL; SBEL receiver cites spending irregularities

BELIZE CITY, Thurs. May 9, 2024

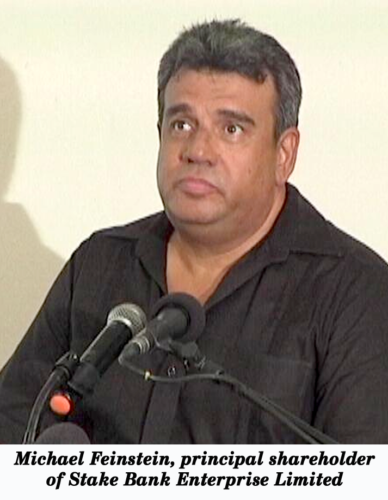

The litigation that Atlantic Bank has initiated for fraud against Port Coral developer Michael Feinstein, the principal shareholder of Stake Bank Enterprise Limited (SBEL) which is now under an Atlantic Bank ordered receivership, is in its preliminary stages. Sources tell Amandala that Feinstein is expected to submit his defense, after which the matter is expected to proceed to case management stage.

In the meantime, an application for an interim injunction so that Feinstein does not dispose of, or encumber the 23.4-acre extension to the 16.085-acre original Stake Bank Island for the Port Coral cruise port project and other assets estimated to value $3.89 million, was decided in court today. The parties appeared before High Court Justice, Hon. Mohamed Mansoor who delivered a consent order based on an out-of-court agreement of the parties that no assets will be disposed of or encumbered by Feinstein until the substantive case is ruled on in court.

As the biggest receivership case in Belize’s history continues to unravel, the Feinstein Group on Tuesday called on the Governor of the Central Bank of Belize, Kareem Michael to designate an independent inspector or team of inspectors to conduct an investigation into Atlantic Bank Limited (ABL). After the receivership of SBEL was executed by the receiver, Marlowe Neal on March 14, 2024, Feinstein had his attorney, Godfrey Smith, KC, send a lawyer letter to the Central Bank making several allegations about the lending institution as regard the syndicated loan it is overseeing for SBEL, whose sole business was to see the Port Coral project at Stake Bank to completion. Feinstein subsequently called for the Central Bank to investigate certain activities of ABL. Atlantic Bank categorically denied the allegations and said it would consider a lawsuit for defamation. When asked if there had been a response from the Central Bank to his letter, Smith told Amandala on May 1 that he believes “the Central Bank of Belize is taking the matter absolutely seriously and looking at the allegations – as it should, as it’s obliged to do, as it is doing, as far as I am aware.”

In its statement issued on Tuesday, May 7, the Feinstein Group affirms that its request for an independent investigator is based on the fact that there is a need for impartiality and objectivity of an investigation into the Bank. Amandala reached out to the Central Bank to confirm if indeed the regulator has launched any investigation into ABL, but we have not received a response.

For his part, also on Tuesday, receiver Marlowe Neal issued a statement of his own. He clarified that the total debt of SBEL currently exceeds BZ$200 million, though the original cost for the Port Coral project which he says was presented to the lenders by Feinstein was US$80 million. Neal added that SBEL has exceeded that estimate by some US $40 million. According to Neal, seeing the project to completion will require another US$70 million. In that regard, Neal affirms that, while the lenders had been told that the security/collateral for the loans would be a finished functioning cruise port with “sufficient income to repay the loans,” the project is unfinished and SBEL has no income to repay either interest or principal. Neal reports they are currently having an engineering audit done of the 70,000 square-foot unfinished building and covered space on Stake Bank island to determine its value.

Neal declares in his two-page statement that currently what exists on Stake Bank Island is an incomplete pier, unfinished dredging works, and material erosion of the reclaimed portions due to incomplete barrier protection. He goes on to say that in addition, “the project has no income and not a single cruise ship user agreement has been signed. The suggestion that potential buyers exist for the project is completely fictional. In fact, no buyer touted by Feinstein has even commenced due diligence.”

Neal shares that preliminary observations from a forensic audit being conducted of SBEL’s spending of the lenders’ funds, “suggests widespread irregularities including companies besides SBEL unlawfully benefitting.”