Photo: Notice by Belize City Tacos Vendor that

U.S. currency is not accepted

BELIZE CITY, Thurs. May 18, 2023

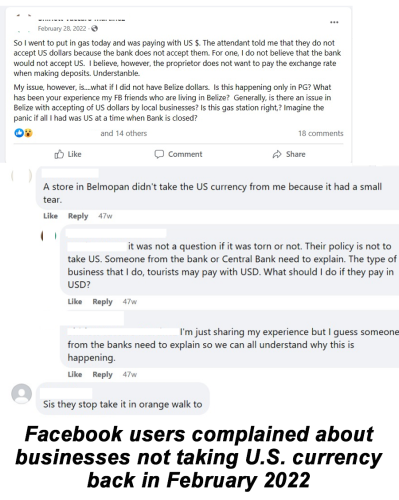

Since February 2022, as documented via social media posts, some businesses in Belize have not been accepting the U.S. dollar as a means of exchange alongside the Belize dollar which is the only legal tender in Belize (as per the Central Bank Act). This has only worsened in 2023 as increasingly, businesses are putting up signs indicating they do not accept U.S. dollars. The development has a ripple effect with the U.S. dollar being more widely rejected by others. However, those in the banking system tell Amandala this is nothing new, as it has happened before, particularly after an event or crisis.

In managing foreign exchange, the Central Bank of Belize authorizes commercial banks to be dealers of foreign currency. They are allowed to sell and purchase the U.S. dollar, but there is a cost to doing so, as U.S. dollars eventually have to be shipped back to the United States where the currency belongs. The Central Bank of Belize prescribes a rate at which these financial institutions can buy and sell U.S. dollars to and from the public. Prior to May 2, 2023, the purchase margin prescribed by the Central Bank to the authorized dealers was between BZ $1.9825 to BZ $2. Thereafter, the Central Bank announced that the rate would be set at BZ $2 for every US $1.

Central Bank Governor Kareem Michael today provided an example of how the public would benefit from this move. He shared, if someone in the tourism sector previously went to a gas station and purchased US $20 in fuel, when the business took the U.S. currency to the authorized dealer, the commercial bank, they would only get back about BZ $38, hence why those businesses would have made the decision to refuse U.S. currency. Among some businesses that Amandala is aware have put up signs rejecting the U.S. dollar are A&R and a tacos vender in Belize City, New Moon Supermarket in Ladyville and even the operator of the bathroom service at the Belmopan bus terminal. The social media post referred to in the first paragraph spoke to a gas station in Punta Gorda doing same. In the comments section, Facebook users pointed to businesses in Orange Walk and in Belmopan also rejecting the U.S. dollar. Asked whether anything can be done about it, Michael reiterated that the legal tender in Belize is the Belize dollar. This means businesses are at liberty to reject U.S. currency as a means of exchange in Belize. Michael says the move to set the buying rate at $2 encourages businesses to exchange their U.S. currency at authorized dealers as opposed to people keeping the money under their bed or selling it themselves on the informal market. Experts tell us if there is a surplus of U.S. currency in the country, which is currently believed to be the case, activity on the black market slows down and selling U.S. currency on the informal market loses value (it can’t be sold to an unauthorized dealer at a mark-up, that is, for higher than $2 to $1), which then is what leads to businesses rejecting the U.S. currency. Currently, the sale of U.S. currency is at the rate of BZ $2.0175.

On the flip side of the coin, now that the Central Bank has set the buying rate for 1 U.S. dollar at BZ $2 for cash instruments (and intends to do the same with other instruments like wire transfers and credit cards beginning June 1, 2023), the commercial banks are negatively impacted. That’s because, as Michael explained the banks’ concern, “they would be losing or incurring more expenses for the administration of certain services and lines of products.” He expressed the hope, however, that their business model “would account already for some of these services and then you are pricing various products to compensate for what may have been lost through this harmonization.” One example would be charging customers a fee to access their money at ATMs. Nonetheless, Michael also hopes that the commercial banks recognize “that the exchange rate is BZ $2 to US $1 – and while we have just focused on the buying part of that, you are still earning a margin on the selling. So, when I now approach a commercial bank to buy foreign exchange from them so I can purchase some good abroad or so I can travel, that commercial bank can still earn a commission on a margin on that. However, when I am the one earning the U.S. dollars, I am simply saying, “no, I want the equivalent of $2.” So, it’s not that you have lost all income – it’s just that you are not getting bites twice at the cherry. So, we are hoping that there is not a knock-on effect on other services, other business products of the commercial banks. Because obviously, the exchange rate is BZ $2 to US $1 and we want to incentivize or get more U.S. dollars in the official system and not steer it to the black market. Obviously, if you are getting more, then your possibility of selling more and earning more commission on the selling part increases.”

On a related note, Michael notified that they are also looking at other fees levied on depositors by commercial banks. He revealed they have done some analysis and identified a few services or fees where “there might be scope for the regulator to limit or restrict. But, key to all of this is also … transparency, disclosure, fairness – that sort of thing. Because, admittedly, the banks are free to offer a service in a particular product line and to make charges tied to those. However, what we want to make sure is that those types of service lines are ‘properly communicated, transparent, that they are fair, in a sense. And so, part of what we are looking at when we are targeting certain fees, certain lines of services, are those other things …” He highlighted that in the future, the enactment of a financial consumer protection law would help to make things better for the general public when it comes to the banking sector.

Michael also explained that what is happening in Belize when it comes to the rejection of the U.S. dollar by some businesses and the setting of the buying rate has nothing to do with the strength of the U.S. dollar worldwide as a global reserve currency, meaning one that is accepted for trade worldwide.