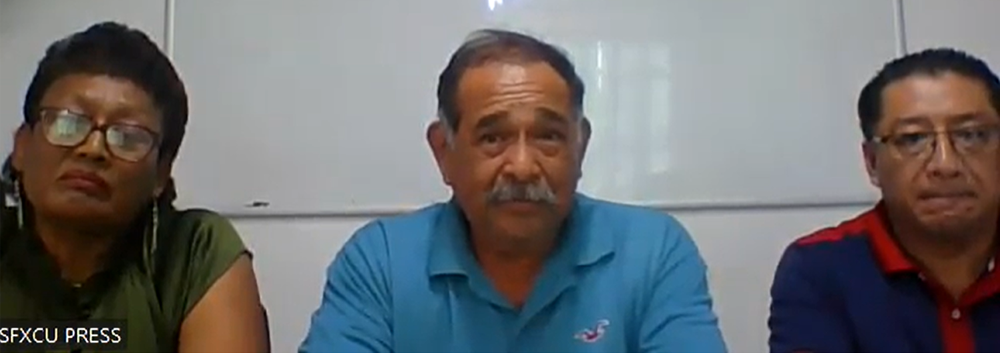

Photo: Board of Directors (l -r) Mayet Castillo, Everaldo Puc, and Rafael Dominguez, Sr.

by Kristen Ku

COROZAL TOWN, Wed. Mar. 16, 2023

Following the installation of an administrator over St. Francis Xavier Credit Union (SFXCU), by the Central Bank Governor, Kareem Michael, the Credit Union’s board of directors and staff members held a press conference to express their displeasure at the decision.

Tuesday’s Amandala had reported that Michael, who also serves as the Registrar of Credit Unions, decided that, due to what appeared to be unsound decisions at SFXCU that put at risk the stability of the second largest credit union in the country, all powers of decision-making would be removed by the Central Bank from the credit union’s general manager (GM) and board members and that authority would be transferred to the Central Bank-appointed administrator.

According to Michael, two extensive examinations of the organization and its operations revealed critical deficiencies, including incompetence, unaccountability, and misuse of finances within the management.

Michael particularly noted the high legal fees paid to contest what was deemed to be the wrongful termination of Rafael Dominguez, Sr. the general manager, from his post, and also compensation awarded to him for that purportedly wrongful termination. According to Michael, the total amount expended by the credit union to address that termination was in the range of $100,000.

It was these results that prompted the appointment of an administrator to take over all facets of the organization’s operations, thus stripping all authority from SFXCU’s management, including that of the president of the board and the general manager.

However, on Tuesday of this week, SFXCU’s board of directors held a press conference via Zoom, to indicate their opposition to the actions taken by the Central Bank Governor.

Everaldo Puc, president of the SFXCU, described this appointment of the administrator as equivalent to being placed under “dictatorship.” He went on to assert that the Central Bank has imposed unreasonable demands, and further complained that the bank had unfairly labeled them as incompetent and was treating them like children — actions that he said were hurtful.

He then stated that the credit union did not pay the type of legal fees that the Central Bank is claiming that it paid, but that reimbursement was paid for consultation fees for legal services received by the credit union during the period of Dominguez’s illegal removal from his position as GM, as well as a defamation fee of $75,000 for Dominguez during the said period.

“The man’s character was damaged with all the interviews and releases and radio talks that were given; the man’s character was damaged. And there has to be compensation to be paid, and so the board agreed that we were going to pay compensation and pay for damages to the sum of $75,000,” Puc asserted.

The Chairlady of the Supervisory Committee, Mayet Castillo, explained, “I believe that if the members who are sole owners of an institution demand from the board certain things, we, or the board is mandated to do just that; and they demanded re-instatement of Mr. Dominguez. They found legal advice, so they have to pay for whatever is done. Nothing is free nowadays.”

Dominguez also completely denied the allegations of lawyer fees being paid by the board.

“There has been no payment to any lawyer approved by the board of directors on my behalf or any charges from legal claim. These have been strictly for services rendered to the credit union (which were) requested by the board that has to do nothing with the general manager,” he claimed.

He further said, “There might have been an oversight in the minutes, but there is no record that can show on behalf of the lawyer charging the credit union for any services in compensation or any claim that has to do in wrongful termination to the general manager.”